2015 is now underway and all eyes are searching the horizon for signals foretelling this year’s real estate trends. Will 2015 differ from 2014, or will  history repeat itself? Trends by their nature involve time. So attempting in February to predict the market of 2015 is a dicey proposition. But we certainly have a few early clues.

history repeat itself? Trends by their nature involve time. So attempting in February to predict the market of 2015 is a dicey proposition. But we certainly have a few early clues.

Not unlike 2014, supply is still very constrained. Sellers are failing to come to market in any significant numbers – causing the supply of homes for sale to fall well below “normal†amounts. The first signs of this showed up in December, which was the first month in 2014 that active listings were lower than they were in the corresponding months of 2013. As a case in point, in the last 7 days of December, new listings were down 13% compared to 2013 and down 14% compared to December 2012. Beginning 2015, available homes were lower than any point of 2014 for Phoenix, Anthem, Avondale, Gilbert, Glendale and Tempe. In fact, El Mirage was at its lowest point of available homes in the last 10 years! Of course there were exceptions – such as Sun Lakes, Maricopa and Paradise Valley. But, this still seems to have been the first signal for 2015 trends – low supply of homes. Here is what our favorite real estate trend watcher, Michael Orr, recently had to say:

“There have been a total of 4,353 new listings added since the start of the year (across all areas & types) which is 9.1% below 2014 and 1.3% below 2013. This is a low number and suggests that supply trends are weak despite the seasonal increase in active listings that we see in January every year. In fact it is a new record low for the 15 year period 2001-2015.

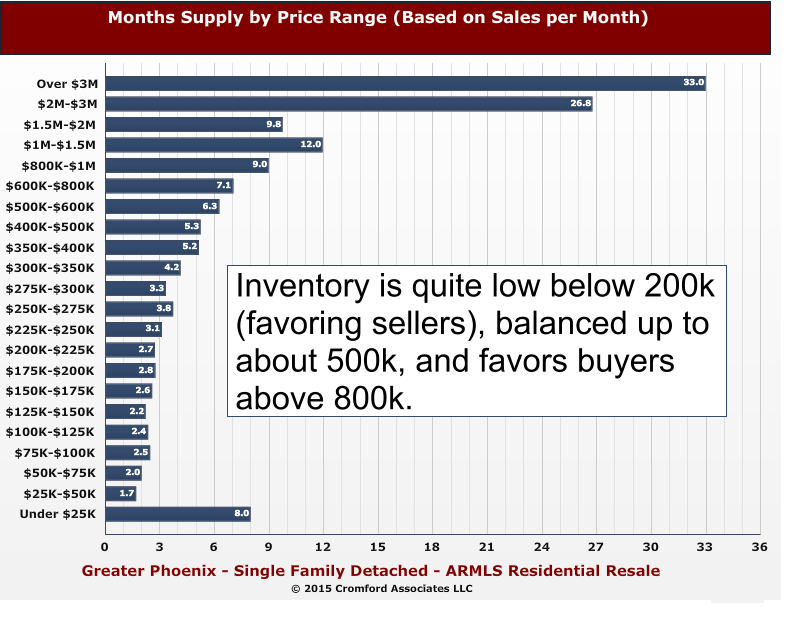

New supply is particularly weak at the bottom of the market under $200,000 while it is quite strong over $800,000.

Sellers of entry level homes are going to have less competition while sellers at the top end are going to have more competition compared with last year.

The new supply of short sales and REOs across greater Phoenix is much lower than in any of the years since 2008, but is higher than 2007 and all previous years since 2001. HUD homes are down to insignificant levels, lower than all years since 2001 except 2005 through 2007.â€

As referenced, the luxury market is a market unto itself. It rarely acts in unison with the market as a whole. For instance, supply remains heavy in the luxury market, despite December 2014 being a huge month for luxury homes sales. December 2014 was the best December for luxury sales since 2006 with 109 closed transactions across Greater Phoenix for homes priced at $1 million and above. But make no mistake; luxury supply still well outpaces demand.

Thankfully, the buyer mix has shifted away from investors and back to an owner occupied dominant market. We are of the mind that this is a good thing – as we have mentioned in previous articles. Abnormally large investor activity is a sign of a very unhealthy market – such as was the case in the over-exuberant market of 2005 or the walking dead market of 2009. In 2015, we are back at a market where the buyer is the end user. Recent changes to lending are now arriving to stimulate the market – particularly the first time buyer market (are you listening millennials?) President Obama’s visit to Russell’s alma mater (Central High) was perhaps more news worthy than noteworthy – but he did announce the changes to FHA‘s insurance program that will assist a small segment of the population. The drop in the cost of FHA insurance gives buyers in this price range an approximately additional $20,000 of buying power. Add to that Fannie Mae and Freddie Mac’s new lending programs with 3% down – helping homeowners who didn’t have the 5% down typically required and who may have exceeded FHA’s loan limits (currently $271,050 for FHA, $417,000 for Fannie/Freddie conventional loans).

Given our low supply and our slightly stronger demand, our market has drifted from a slight buyer’s market to a balanced market. If this trend continues, we could very quickly see seller’s regaining the upper hand in negotiations. In fact, should demand increase in any significant way, it will rapidly overtake our supply. It will take a bit of time for the constraint to result in higher pricing – price being a trailing indicator- but it will show up.  If this comes to pass, Buyers may be wishing they bought in 2014. What is good for the duck hunter is rarely good for the duck.